Your September 2025 Monthly Market Update

Happy October Everyone,

With temperatures dropping these past few weeks, the real estate market feels like it’s settled into a new “norm”— we are relief that the sales has picked up since the summer months but at the same time worried that September sales came in just a touch below August. That’s notable because August is often one of the quieter months of the year, and instead of a September falls pike, we saw a further dip.

In this newsletter, I am going to show you even with the increase in sales activity compared to 2024, we are in-fact in a deeper buyer’s market than even Spring time.

We have previously mentioned about month of inventory as a good gauge of the market so that is will be what we want to focus on this month in order to get the better picture about what is happening with our market. For anyone that needs a quick refresher, the way to consider Month of inventory (MOI) in relationship to the market is as follows:

- Seller’s Market – 0-4 months of inventory

- Balanced Market – 4-6 months of inventory

- Buyer’s Market – 6+ months of inventory

- Strong Buyer’s Market – 7+ month of inventory

I have customed a chart where you can see how our MOI has been like in 2025.

From this chart, you can clearly see 3 patterns:

1) We have been in a deep buyer’s market (7+ months of MOI) since the beginning of this year and things got worst once we had the tariff discussion.

2) Our MOI has increased steadily since March with the only expectation being July

3) September is now holding onto the HIGHEST MOI in 2025 even with our sales stabilizing and even doing slightly better than 2024.

This is the main reason why our benchmark pricing have been experiencing the downward pressure.

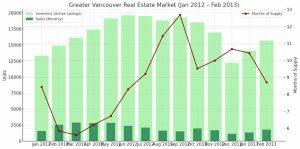

In order to put things into perspective, I picked out another 2 period of time where it was also very buyer’s dominated market in the last 15 years as comparison. Let’s start off in 2012 when we tighten up the lending rules after the post 2008 boom.

We can easily see that 8 MOI is indeed bad, but things could easily get even worst with over 10 months of inventory that experienced both in 2008 and 2012.

In both past scenarios our MOI started to decrease about 6-9 months of steady increase. if we take July out of the picture from 2025, we are 5 months of steady increase now. IF history repeats itself, we SHOULD be in for a busier spring in 2026 – but the timing still depends on rates, policy and the flow of new listings.

So with the MOI continuously increasing, how is this impacting our prices? Well it has kept its strong downward pressure on price, take a look at the chart below that continues from last months newsletter of % of price change YoY.

With a decrease of 3.2% YoY in September that is slight improvement from the 3.8% decrease YoY in August but we are STILL FIRMLY negative. This is basically continue the statement we have determine last month.

“The increase in sale is a result of the falling of price”

This is extremely different from sales activity is increasing due to positive economic data and/or government policies.

Looking Ahead:

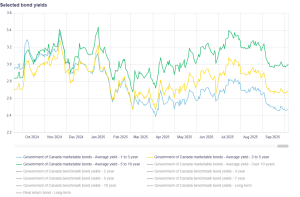

With the bond market anticipating a Bank of Canada rate cut in September, Government of Canada yields drifted lower early in the month, then held roughly steady after the decision. The Bank did cut 25 bps on September 17, taking the policy rate to 2.50%

Once the cut was delivered, the uncertainty was removed and yields stabilized as investors paused to reassess the outlook. Through late September, the 5-year GoC yield hovered in a narrow range (~2.72–2.79%), consistent with that “edge-down then

With further rate cut now expected for the rest of 2025 and beginning of 2026, we can expect similar movement in the next several months.

As long as the Bank of Canada is thinking of cutting, this is where I would say taking a variable AT THIS MOMENT would be a better move than fixed rate mortgage. Should you take variable, everytime the Bank of Canada is going to drop rates, you will also be able to benefit from it. However if you choose a fixed rate mortgage now, you will not be able to enjoy the future drops.

This is risk free move as you have the ability to go from variable rates to fixed rates with a simple call WITHOUT PENTLATY to your favorite bank. However, good luck dealing with the bank trying to switch from fixed rate to variable!

Rentals:

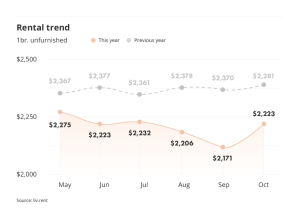

Time for some genuinely good news this month: average rents in Greater Vancouver shot up in October. The City of Vancouver led the way with just over a 6% month-over-month jump, and we also saw increases in Langley (3.58%), Richmond (2.49%), North Vancouver (2.78%), and West Vancouver (a big 7.44%).

Before we start calling this a full-on bounce back, a quick reality check: October is always a hot rental month. It’s the last busy stretch before people settle in for the holidays, so I’d expect a dip in November, December, and maybe even January—similar to how the sales market tends to hibernate.

The other reason not to pop the champagne yet: oversupply. We’re still dealing with a wave of purpose-built rentals—over 5,000 came online in 2025, and more than 7,000 are projected for 2026. Unless immigration meaningfully re-accelerates (like the post-COVID surge), that added supply will keep downward pressure on rents. And right now, it’s hard to see Canadians embracing that level of inflow again.

All that said, I’ll happily take a spike like this over the steady declines we saw through most of 2025. Just remember: one data point doesn’t make a trend. Let’s see how the next few months shape up as we head into 2026.

Final Thoughts:

Yes our sales activity seems like it’s been trending the right way since the summer time where we have matched and/or slightly beat 2024 sales activity numbers in the last several months. That is definitely something to be very happy about. However, should you just read the headline news, you might miss the bigger picture. Why?

- Our new listings and total inventory is still way above 2024 numbers creating much stiffer competition between listings.

- With the imbalance of new listings and sales activity, our Month of Inventory (MOI) is now at the highest level in 2025, meaning we are actually deeper in a buyer’s market than even spring due to the amount of selection.

- The high inventory level is what is causing the price to drop. This promotes more buyers to start purchasing.

- The latest interest rate drop also helps with affordability but it’s most likely NOT that main reason our sales activity is increasing. That still most likely come down to the accelerated the price drop we have experience since late summer.

If you have any questions about buying, selling, investing, or just want to plan your next move, I’m always happy to chat.

Stay Warm Everyone!