Happy November everyone,

Just like that, we’re down to the last several weeks of 2025. What a rollercoaster this year has been.

October is typically the last sales peak before the real estate market slows down for the Christmas holidays, and this year we did follow that seasonal trend with an uptick in sales compared to September. That said, October 2025 sales still lagged the same time last year by 14.3%, after actually surpassing year-over-year sales in September by 1%. In other words, we’re back to what has now become our “normal” — sales activity sitting about 10%–20% below the same time last year.

Even with the uptick in sales, October 2025 followed the same pattern we’ve seen all year: new listings continue to outpace sales. As a result, total inventory remains elevated — we’re sitting at 13.2% more total inventory than this time last year.

Another thing to keep in mind: even though our overall listing count is lower than the peak in June, that’s likely because a growing number of sellers are pulling their listings off the market. Many are choosing to try again next spring, or simply renting their homes out instead. This is extremely common in a tougher market, especially here where not everyone can afford to leave a property sitting vacant — particularly with the Empty Homes Tax and Speculation & Vacancy Tax in play.

When you combine all of this and look at our Months of Inventory (MOI) for last month, we’re still sitting above 7 months of inventory, which firmly indicates a buyer’s market.

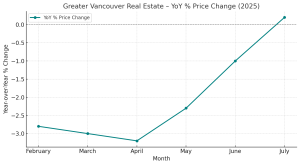

With MOI still well above 7 months, plus everything mentioned above, it’s not surprising that our year-over-year price change is still very negative at -3.4% for October.

Since May 2025, we’ve been floating north of a -2.5% YoY price change. That tells us a few things:

- One month of data can be noise, but 3–6 months of sustained negative year-over-year numbers tells us we’re still in correction mode.

- Buyers are still uncertain or waiting for further price drops — classic low buyer sentiment.

- The market has not yet found its new “floor” price under this environment.

- Any claim that the market is “rebounding” right now would be, frankly, a false statement.

For comparison, a market that looks like it’s starting to stabilize would show a YoY chart more like this:

- April: –3.2%

- May: –2.3%

- June: –1.0%

- July: –0.4%

This kind of pattern would suggest that prices are still falling, but the rate of decline is shrinking — meaning we’re possibly starting to bottom out. Below is a picture of how that would look like from the chart.

Until we see something similar to that example, we should expect prices to continue drifting downwards until the market finds its new floor — essentially, the price level that the majority of buyers are finally willing to accept.

Looking Ahead:

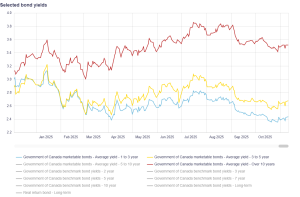

With the Bank of Canada’s most recent rate drop, that is definitely something to celebrate for anyone with a variable-rate mortgage. However, as I’ve mentioned before, a Bank of Canada rate cut does not directly impact fixed mortgage rates. Fixed rates follow the Canadian bond yield, not the overnight rate.

If you look at the bond yield chart below, you’ll see that in October we had a brief dip, but it was short-lived. We’re now basically back to where we were at the start of October 2025.

In fact, after such an up-and-down year with trade tensions, geopolitical risks, and everything else going on, our bond yields are more or less right back to where they were in March/April 2025.

If you’re thinking about locking into a fixed rate and trying to “time” the market, I’d suggest focusing on a few key indicators:

- Unemployment rate

- Inflation expectations

- Government budget and funding needs (will the government need to issue more bonds soon?)

- U.S. economic data

Rentals:

Unfortunately, by the time I’m sending this email, the latest rental report from Liv.rent still hasn’t been published. As much as I’d love to deliver a completely “finished” newsletter, I also need to make sure it goes out in a timely manner. So for this month, we’ll have to skip the detailed rental segment.

That said, looking at other platforms that track rental data across Canada, it appears that after the brief spike we saw in October (some rare good news!), we’re now back to “regular programming” with rents continuing to trend down overall. Exactly by how much — we’ll have to wait and see. I’ll break it all down for you in next month’s newsletter, so stay tuned!

Final Thoughts:

As we wrap up the fall market, it’s pretty clear it’s been the same story across most areas: sellers are outpacing buyers.

What’s interesting is that with variable and fixed rates now sitting in a very healthy range of around 3.5%–4%, and prices down 5% to sometimes over 10%, affordability—while still a challenge—is nowhere near as bad as it was at the peak of the market. We had similar interest rates back in 2021, but the market was doing something COMPLETELY different back then.

From a fundamental and analytical point of view, we’re actually in a much better position today than last couple of years. The main reason we’re not seeing buyers flood back in comes down to one thing: buyer sentiment. Without some kind of major shift, I’d expect buyer sentiment to stay weak for the rest of 2025.

Looking ahead to 2026, if we want to see prices truly rebound, the key will be resolving what’s driving this poor sentiment. That’s not easy in the current environment, with Canada’s labour market and GDP slowly softening and many economists predicting we will most likely enter a recession in 2026. What the Bank of Canada decides to do next—if labour data and GDP continue to weaken—will play a big role in where the real estate market goes from here.

As usual, from a buyer’s perspective, THIS IS THE PERFECT TIME to get into the market or to upsize. It’s now beyond rare to have the kind of conditions we’ve seen in 2025: elevated inventory, motivated (and sometimes desperate) sellers, and manageable interest rates. Together, that creates one of the best buying environments we’ve seen in a long time. My buyers who have been active during this period have all been pleasantly surprised at where prices are sitting right now.

If you have any questions about buying, selling, investing, or just want to plan your next move, I’m always happy to chat.

Stay warm, everyone!

If you would like to see the full post, please click here for the full monthly newsletter!